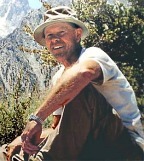

Standing in front of his top executives two years ago, Frank L. Amodeo bragged about growth prospects of his investment brainchild, Mirabilis Ventures Inc. He pledged to succeed where competitors, other Fortune 500 companies and even the Pentagon had failed.

On Friday, the Orlando-based holding company disclosed it had lost at least $220 million and had closed down virtually all of its operations.

"Mirabilis is shutting down, and we are in collection mode so we can recover assets owed to the company and pay off its obligations," said Bob O'Malley, a public-relations consultant hired by the company.

Mirabilis, which is under investigation by a federal grand jury in Orlando, also announced it is suing former top company executives and creditors, claiming they defrauded or owe money to the firm.

Money recovered from the lawsuits will be turned over to the Internal Revenue Service, which O'Malley said is trying to determine the company's tax liabilities and whether it is responsible for millions of dollars in payroll taxes collected by a human-resources firm linked to Mirabilis that were never paid to the government.

Mirabilis was an obscure company until three security contractors working for Amodeo were detained in the Democratic Republic of Congo in May 2006. At the time, Mirabilis owned or held investments in 70 companies, including construction, restaurant, insurance, defense consulting and human-resource-payroll firms.

Company officials claimed revenues of nearly $1 billion last year before it laid off scores of workers starting in December.

Alleged wrongdoing

Litigation filed recently in Orange Circuit Court allege wrongdoing by a number of Mirabilis business associates:

A fraud lawsuit accuses the former owners of RKT Constructors of Titusville, Robi A. Roberts, a trust she controlled, and F. Del Kelley of inflating the assets of the company. Mirabilis paid $3.2 million for RKT in December 2005. Roberts said Friday the allegations were untrue.

A suit against Palaxar Group LLC, ex-Mirabilis President Frank Hailstones and ex-secretary-treasurer Edith Curry alleges the executives breached contracts with Mirabilis and misappropriated trade secrets and patents developed by the company before they left. The suit said the former executives are marketing an anti-fraud product that would deprive Mirabilis of revenue. Neither could be reached for comment.

A breach of contract suit against ex-Mirabilis Vice President Robert Konicki and Premier Servicing LLC concerns the $1.1 million sale of three Mirabilis insurance subsidiaries -- Cadent Underwriters, Bencomp National Corp. and Community Health Solutions of America LLC -- to Premier earlier this year. It says Premier defaulted on its September and October payments and that Konicki structured the deal thinking Mirabilis would collapse before all payments were collected. He still is an officer with the three insurance firms, the suit said.

Konicki's lawyer, William Sheaffer, called the lawsuit "baseless" and an "attempt to deflect attention on issues being investigated by the federal government."

The IRS, FBI and a federal grand jury are looking at the business dealings of Mirabilis, its subsidiaries and Amodeo-related companies. Assistant U.S. Attorney Randy Gold, who is running the probe, declined comment Friday because it was ongoing.

The investigation has focused on company acquisitions and more than $100 million in unpaid employment taxes collected by payroll-outsourcing companies tied to Mirabilis or Amodeo, including Presidion Solutions Inc., witnesses said.

Justice suits dropped

Earlier this summer, the Justice Department filed five lawsuits seeking up to $223 million in back taxes dating to 2001. But the suits quietly were dropped by prosecutors, apparently because they were filed prematurely.

O'Malley said Mirabilis has settled 16 of 24 business lawsuits filed against it across the country this year. In the remaining suits, the company has filed counterclaims seeking $14 million. More suits will be filed in the coming weeks, he said.

Numerous other disputes have been resolved without litigation, he said, including one involving nearly 500 workers who complained that about 2,000 health-insurance claims had not been paid.

Mirabilis, which once employed 400 workers in three downtown Orlando office towers, is now down to a handful of personnel. The company is reviewing 20,000 hours of internal office surveillance tapes -- which also have been turned over to prosecutors -- to find which former employees are culpable in unscrupulous dealings, O'Malley said.

Amodeo, 47, has served as Mirabilis' chief strategist and primary investor since 2005. O'Malley said the company would stay in business indefinitely while it collects its debts.

"The bottom line is he [Amodeo] is still around," he said. "He is very much trying to do the right thing and has had some good people who have stuck with him."

Some are skeptical

In July 2006, the Orlando Sentinel disclosed that Amodeo was disbarred as a Georgia bankruptcy lawyer in 1994 and served two years in federal prison for fraud.

Robert Sacco, owner of PaySource Inc. of Dayton, Ohio, remains skeptical of Amodeo and Mirabilis. He sued both in April, alleging they defaulted on the $22 million purchase of his human-resources firm. Sacco claims he lost $4 million taking back the company and fixing its operations.

"The guy acquired over 100 companies and didn't [fully] pay for them," Sacco said. "His actions and the consequences of his actions have caused collateral damage to thousands of people."

Orlando company says it will try to recover assets

On Friday, the Orlando-based holding company disclosed it had lost at least $220 million and had closed down virtually all of its operations.

"Mirabilis is shutting down, and we are in collection mode so we can recover assets owed to the company and pay off its obligations," said Bob O'Malley, a public-relations consultant hired by the company.

Mirabilis, which is under investigation by a federal grand jury in Orlando, also announced it is suing former top company executives and creditors, claiming they defrauded or owe money to the firm.

Money recovered from the lawsuits will be turned over to the Internal Revenue Service, which O'Malley said is trying to determine the company's tax liabilities and whether it is responsible for millions of dollars in payroll taxes collected by a human-resources firm linked to Mirabilis that were never paid to the government.

Mirabilis was an obscure company until three security contractors working for Amodeo were detained in the Democratic Republic of Congo in May 2006. At the time, Mirabilis owned or held investments in 70 companies, including construction, restaurant, insurance, defense consulting and human-resource-payroll firms.

Company officials claimed revenues of nearly $1 billion last year before it laid off scores of workers starting in December.

Alleged wrongdoing

Litigation filed recently in Orange Circuit Court allege wrongdoing by a number of Mirabilis business associates:

A fraud lawsuit accuses the former owners of RKT Constructors of Titusville, Robi A. Roberts, a trust she controlled, and F. Del Kelley of inflating the assets of the company. Mirabilis paid $3.2 million for RKT in December 2005. Roberts said Friday the allegations were untrue.

A suit against Palaxar Group LLC, ex-Mirabilis President Frank Hailstones and ex-secretary-treasurer Edith Curry alleges the executives breached contracts with Mirabilis and misappropriated trade secrets and patents developed by the company before they left. The suit said the former executives are marketing an anti-fraud product that would deprive Mirabilis of revenue. Neither could be reached for comment.

A breach of contract suit against ex-Mirabilis Vice President Robert Konicki and Premier Servicing LLC concerns the $1.1 million sale of three Mirabilis insurance subsidiaries -- Cadent Underwriters, Bencomp National Corp. and Community Health Solutions of America LLC -- to Premier earlier this year. It says Premier defaulted on its September and October payments and that Konicki structured the deal thinking Mirabilis would collapse before all payments were collected. He still is an officer with the three insurance firms, the suit said.

Konicki's lawyer, William Sheaffer, called the lawsuit "baseless" and an "attempt to deflect attention on issues being investigated by the federal government."

The IRS, FBI and a federal grand jury are looking at the business dealings of Mirabilis, its subsidiaries and Amodeo-related companies. Assistant U.S. Attorney Randy Gold, who is running the probe, declined comment Friday because it was ongoing.

The investigation has focused on company acquisitions and more than $100 million in unpaid employment taxes collected by payroll-outsourcing companies tied to Mirabilis or Amodeo, including Presidion Solutions Inc., witnesses said.

Justice suits dropped

Earlier this summer, the Justice Department filed five lawsuits seeking up to $223 million in back taxes dating to 2001. But the suits quietly were dropped by prosecutors, apparently because they were filed prematurely.

O'Malley said Mirabilis has settled 16 of 24 business lawsuits filed against it across the country this year. In the remaining suits, the company has filed counterclaims seeking $14 million. More suits will be filed in the coming weeks, he said.

Numerous other disputes have been resolved without litigation, he said, including one involving nearly 500 workers who complained that about 2,000 health-insurance claims had not been paid.

Mirabilis, which once employed 400 workers in three downtown Orlando office towers, is now down to a handful of personnel. The company is reviewing 20,000 hours of internal office surveillance tapes -- which also have been turned over to prosecutors -- to find which former employees are culpable in unscrupulous dealings, O'Malley said.

Amodeo, 47, has served as Mirabilis' chief strategist and primary investor since 2005. O'Malley said the company would stay in business indefinitely while it collects its debts.

"The bottom line is he [Amodeo] is still around," he said. "He is very much trying to do the right thing and has had some good people who have stuck with him."

Some are skeptical

In July 2006, the Orlando Sentinel disclosed that Amodeo was disbarred as a Georgia bankruptcy lawyer in 1994 and served two years in federal prison for fraud.

Robert Sacco, owner of PaySource Inc. of Dayton, Ohio, remains skeptical of Amodeo and Mirabilis. He sued both in April, alleging they defaulted on the $22 million purchase of his human-resources firm. Sacco claims he lost $4 million taking back the company and fixing its operations.

"The guy acquired over 100 companies and didn't [fully] pay for them," Sacco said. "His actions and the consequences of his actions have caused collateral damage to thousands of people."

Orlando company says it will try to recover assets

SOURCE

No comments:

Post a Comment